Macroeconomic Report of Ho Chi Minh City (Part 1): The overview of the Economies of the World, Vietnam and Ho Chi Minh City in 2023

11 January, 2024

University of Economics Ho Chi Minh City (UEH) and Statistics Department Ho Chi Minh City officially launched “Ho Chi Minh City Macroeconomic Report: Results of 2023 and Forecast for 2024”. This is a scientific research publication by UEH and Ho Chi Minh City Statistics Department coordinates the implementation to provide a comprehensive view of Ho Chi Minh City’s Economy in 2023 regrading the achieved results, forecasts, prospects for 2024 and to propose the suggested policies for Ho Chi Minh City government.

In part 1 of this article, an overview of the world economy, Vietnam’s economy and Ho Chi Minh City is to be presented as follows.

Overview of the world and Vietnam economy

*World economy

By the end of 2023, the world economy is being in the process of recovering after a period of heavy impact by the COVID-19 pandemic, armed conflicts and geopolitical tensions are on the rise in the world. Although the world economic outlook has shown more positive signs, the recovery path is expected to have many challenges in 2024. In accordance with the World Economic Outlook forecast of the International Monetary Fund (IMF), the world economy will grow approximately 3% in 2023 and slow down at 2.9% in 2024. Two decades before the COVID-19 pandemic, the average growth rate per year of the world economy is approximately 3.8%. In the US, the economy is coping well with interest rate increases by the Federal Reserve (FED) while inflation continues to cool down. The IMF forecasts US economic growth in 2023 to be 2.1%. However, the FED is committed to keeping interest rates high and prolonged to bring inflation back to the target level. The US financial market also indicates the signs that the FED’s previous consecutive interest rate increases have begun to have more impact on the country’s economy. The IMF forecasts US economic growth in 2024 to be 1.5%. Contrary to the situation in the US, major economies in Europe are generally affected by interest rate increases by the European Central Bank (ECB). The largest economy in the euro area, Germany, is forecast to fall into a mild recession in 2023 (negative growth of 0.5%), and the entire euro area will grow modestly at 0.7%. However, the IMF forecasts that growth will return to Germany in 2024 at 0.9% and the common currency area at 1.2%. In Asia, the Chinese economy is facing many challenges after a long period of freezing due to the COVID-19 pandemic. The IMF forecasts that the Chinese economy will grow by 5% in 2023 and slow down at 4.2% in 2024. The Indian economy is forecast to grow positively at 6.3% in 2023 and maintain a healthy growth rate in 2024.

*Vietnam economy

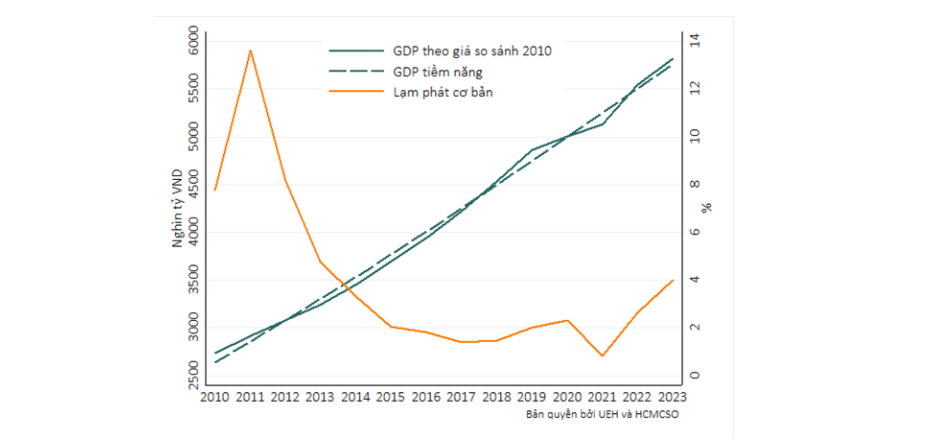

The world economic picture is full of fluctuations and unpredictable risks that greatly affect the Vietnamese economy. The IMF forecasts that Vietnam’s GDP will grow at 4.7% in 2023 and 5.8% in 2024. Although the National Assembly set higher targets, this growth rate is quite high compared to other economies in the world. In accordance with the research team’s analysis, Vietnam’s economy has quickly regained growth momentum after two years of being heavily affected by the COVID-19 pandemic. Figure 1 presents that the actual output (measured by GDP at constant prices) has returned to closely follow potential output (measured by potential GDP) as well as to regain the potential growth trend that was present from 2010s. This demonstrates that Vietnam’s economy has returned to a state of balance between the total demand for goods and services on the one hand and the supply capacity of the economy on the other. The balance between aggregate demand and supply capacity is one of the main factors that have caused the general price level of the Vietnamese economy to remain at the target level over the past decade, after a period of sharp increases fluctuated in the late 2000s and early 2010s. Figure 1 indicates that core inflation has been maintained stably below 4% over the past 10 years. On average for the whole year 2023, core inflation is estimated at nearly 4%. Although still below target, this is the highest figure in a decade. The main reason is that the supply capacity of the Vietnamese economy is negatively affected by fluctuations in the global production and supply chain due to the COVID-19 pandemic, armed conflicts and tensions caused by geopolitics. However, the fact that the core inflation fell continuously from January to November partly reflects a deceleration in aggregate demand and signs of improvement in global production and supply chains. This is a favorable context for Vietnam to continue accelerating public investment in 2024.

Figure 1: Vietnam’s GDP and core inflation. Source: General Statistics Office and research team’s estimates

Economic growth of HCMC in 2023

*Mid-term trend of the economy

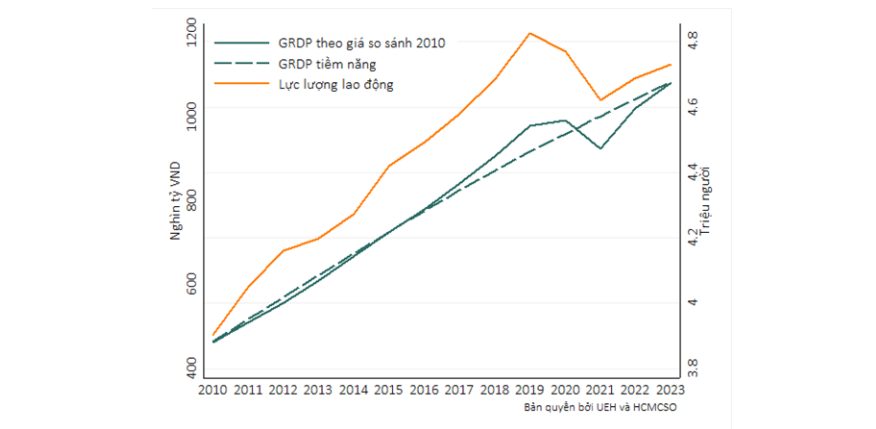

By the end of 2023, GRDP based on the comparative prices of Ho Chi Minh City is forecast to grow 5.81%. Of which the service sector increased by 6.79% and the industry sector increased by 4.42%. According to the research team’s analysis, GRDP is based on city’s comparative prices. Ho Chi Minh City is gradually approaching potential GRDP. This achievement shows Ho Chi Minh City’s economy is recovering steadily after the severe effects of the COVID-19 pandemic. As the largest economic center in the country, Ho Chi Minh City’s economy always achieves a growth rate higher than that of the national average and creates jobs for millions of workers from all provinces and cities. In the opposite direction, it is inevitable that Ho Chi Minh City’s economy suffers the heaviest impacts in the country from the COVID-19 pandemic, armed conflicts and geopolitical tensions are increasing worldwide. According to the research team’s analysis, in the period 2016-2019, the real GRDP of HCM is higher and growing faster than that of the growth of potential GRDP (Figure 2). This reflects that growth during this period was largely due to increased aggregate demand for goods and services, which exceeded the growth rate in the economy’s production and supply capacity.

To meet the increased total demand in the period 2016-2019, Ho Chi Minh City’s economy has welcomed a very large increase in labor force from other provinces and cities across the country. When aggregate demand dropped sharply because of the COVID19 pandemic, the labor force in Ho Chi Minh City also decreased rapidly when many migrant workers went to other provinces and cities. This economic structure makes HCM city’s economic growth has a much larger level of cyclical fluctuations than that of the national average. The hot growth in the period 2016-2019 caused population density in Ho Chi Minh City to increase, revealing many internal bottlenecks in the structure of Ho Chi Minh City’s economy, especially in terms of infrastructure and economic management apparatus. This is an important topic that needs to be analyzed and researched more deeply to provide important scientific arguments in guiding the development of Ho Chi Minh City’s economy. At the qualitative level, the research team believes that the increase in total demand in the period 2016-2019 is due to (1) export demand for labor-intensive goods (textiles and footwear) and (2) investment demand in the housing construction sector created by the real estate bubble. Therefore, the development orientation of high-tech industries and banking and financial services, besides the management and the stable development of the real estate market to meet the housing needs of workers and supplement support for production and business activities are important keys to Ho Chi Minh City’s economy so as to avoid repeating the hot growth situation in the period 2016-2019.

Recovery trend of aggregate demand

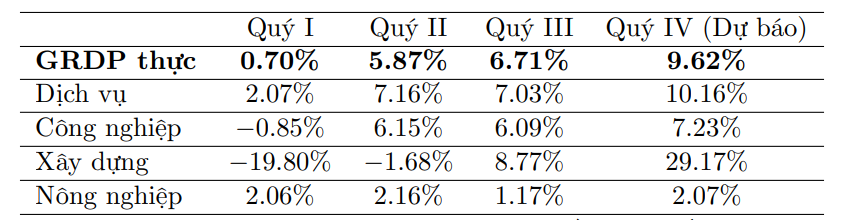

Looking at quarterly data, Table 1 shows Ho Chi Minh City’s GRDP growth rate that is on track to improve significantly each quarter in 2023 (compared to that of the same quarter in 2022). This reflects the aggregate demand for goods and services in Ho Chi Minh City’s economy that is on a steady recovery path, especially the service, industry and construction sectors. The research team expects aggregate demand to maintain this recovery momentum in 2024. A few indicators can indirectly demonstrate the recovery speed of aggregate demand. Figure 3 presents the total retail sales of consumer goods and services, along with revenue from transportation, warehousing, and transportation support services. In the 2020-2021 period, under the impact of the COVID-19 pandemic and other negative fluctuations in the global production and supply chain, both of these indicators stagnated and experienced months of deep decline. The year 2022 will witness a modest recovery in both indicators.

Figure 2: GRDP and labor force of HCMC. Source: City Statistical Yearbook. HCM and the research team’s estimations

Table 1: Actual GRDP growth in the quarters of 2023 compared to that of the same period

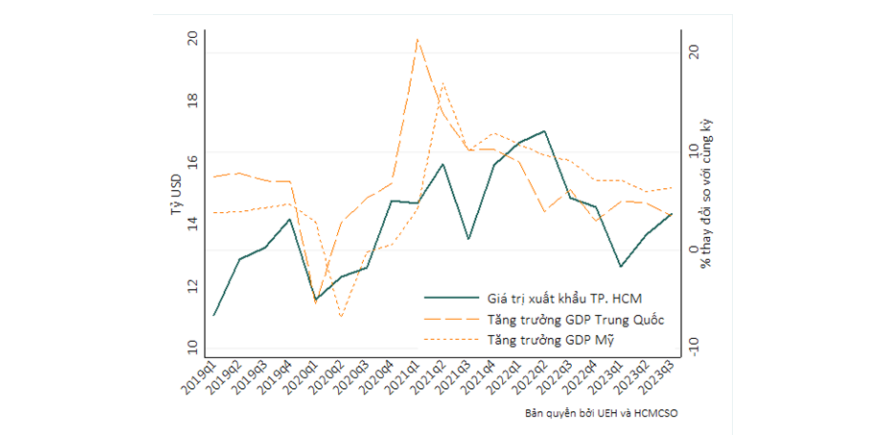

Entering 2023, both indicators illustrate a trend of recovery and more stable growth. Another important indicator that also partly reflects the recovery of aggregate demand is export. Figure 4 presents that the export value of Ho Chi Minh City witnessed a decline at the end of 2019 and the first half of 2020 when HCM City’s two main export markets, China and the US, both experienced negative growth in GDP due to the COVID-193 Pandemic. From the second half of 2020 to the first half of 2021, the export value of Ho Chi Minh City began to increase again when the economies of China and the US grew strongly again after the COVID-19 pandemic. However, from the second half of 2021, the GDP growth of China and the US both tends to decelerate, contributing to a sharp decline in HCM City’s export values in the second half of 2022 and the first quarter of 2023. Although many risks are being available, the export value of HCM City has started to increase again in Quarter II/2023 and Quarter III/2023, which is a positive signal.

Figure 3: Total retail sales of goods and consumer service revenue and Revenue from transportation, warehousing, and transportation support services of HCMC. Source: HCM City Statistics Department

Figure 4: Export value of Ho Chi Minh City and GDP growth in the US and China. Source: HCM City Statistics Department and Federal Reserve Bank of St Louis

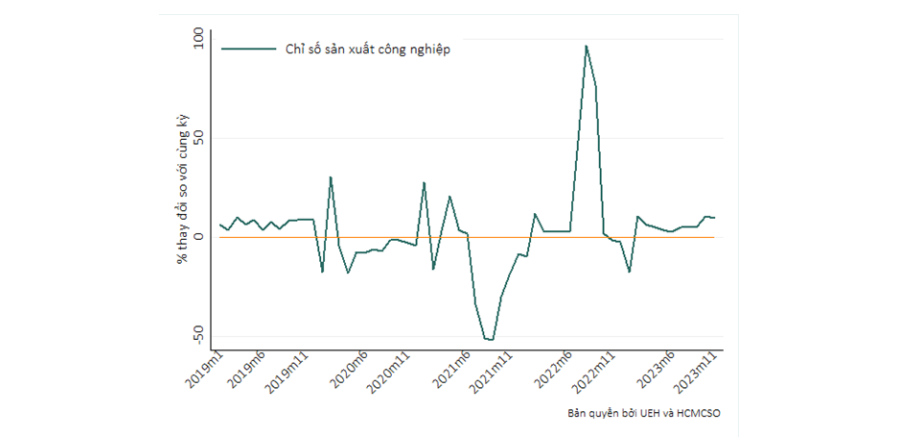

The recovery speed of aggregate demand in Ho Chi Minh City is partly reflected through the industrial production index (IIP). Figure 5 presents the percentage change of IIP by month compared to the same month of the previous year. In 2019, IIP grew at an average rate of 7.2% in every month compared to the same month in 2018. In 2020 and 2021, under the impact of the COVID-19 pandemic and other negative fluctuations in the production chain, global production and supply, IIP in general decreased sharply compared to the same month last year. In 2022 and 2023, IIP regains strong growth momentum but is still unstable, especially in the last two months of 2022 and January 2023. Since February 2023, IIP has begun to grow more steadily and stably, increasing by an average of 6.2% per month compared to that of the same month in 2022.

Figure 5: Industrial production index of HCM City. Source: HCM City Statistics Department

Some other indicators that partly reflect the recovery of aggregate demand are as follows: (1) the number of businesses entering the net market and (2) the number of new FDI projects. Figure 6 presents the number of new businesses entering the market in Ho Chi Minh City has a tendency to recover quite stably in 2023. This index had previously experienced two years of instability due to the COVID-19 pandemic and other negative fluctuations while 2022 had no stable recovery and a deep decrease in the first quarter of 2023. The number of new FDI projects recorded in Ho Chi Minh City reflects the recovery trend from 2022 after two years of instability in 2020-2021 although the number is below the level of 2019.

Figure 6: The number of new businesses entering the market and that of new FDI projects in HCM City. Source: HCM City Statistics Department

The recovery of aggregate demand in 2023 will also receive the support from accelerating disbursement of public investment capital. Compared to that of the same period last year, disbursement of public investment capital in HCMC increased by 0.25% in Quarter I, 164% in Quarter II, and 62% in Quarter III.

Author group: Dr. Hồ Hoàng Anh – University of Economics Ho Chi Minh City (UEH) (Leader); MSc. Nguyễn Văn Thắng – HCM City Statistics Department (Co-leader); Lê Minh Hùng – HCM City Statistics Department; Trần Thị Triêu Nhật – HCM City Statistics Department; MSc. Nguyễn Thanh Bình – HCM City Statistics Department; MSc. Võ Đức Hoàng Vũ – University of Economics Ho Chi Minh City (UEH).

Advisory Board: Prof. Dr. Nguyen Dong Phong – Party Committee Secretary, Chairman of the Council of University of Economics Ho Chi Minh City; Prof. Dr. Su Dinh Thanh – President of University of Economics Ho Chi Minh City; MSc. Nguyen Khac Hoang – HCM City Statistics Department; Prof. Dr. Nguyen Trong Hoai – Editor-in-Chief of Asian Economic and Business Research Journal, University of Economics Ho Chi Minh City; Associate Professor. Dr. Pham Khanh Nam – Vice President in charge of UEH College of Economics, Law and State Management.

This is an article in the series of articles spreading research and applied knowledge from UEH with the “Research Contribution For All – Nghiên Cứu Vì Cộng Đồng” message, UEH cordially invites dear readers to look forward to the upcoming Knowledge Newsletter ECONOMY No. #106.

News & photos: Group Author, UEH Department of Marketing & Communication